south dakota sales tax exemption form

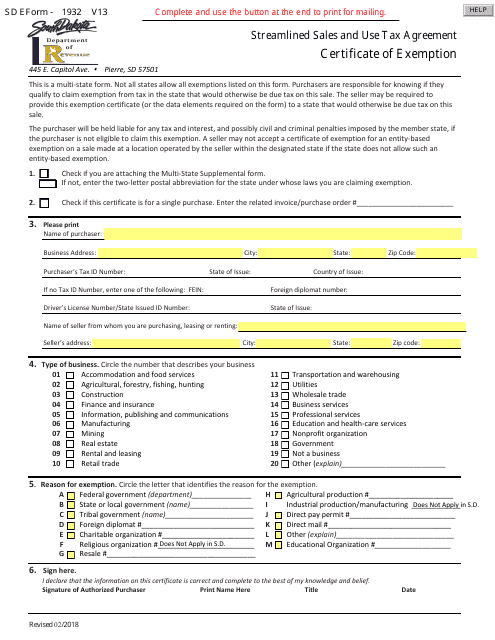

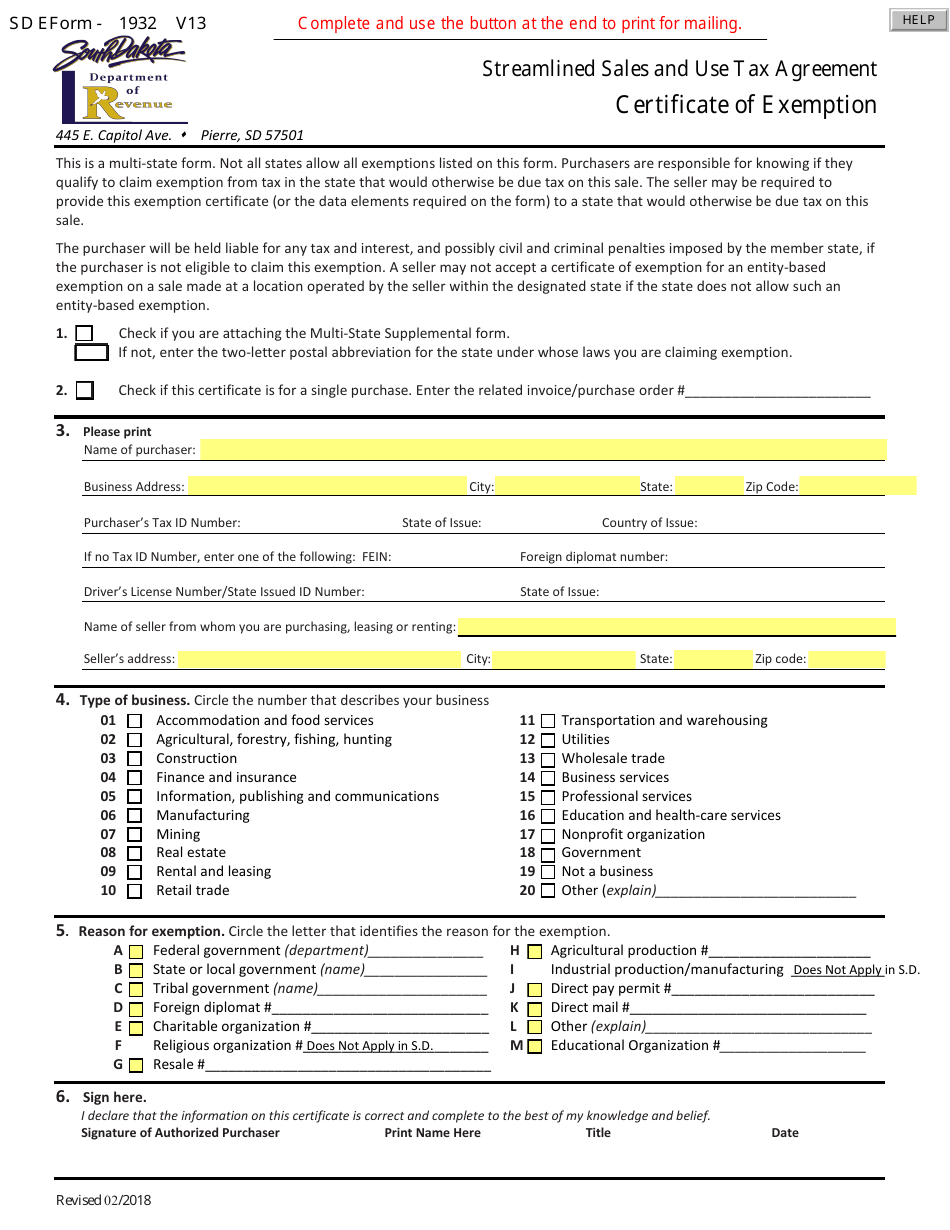

South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that is due tax on this sale.

Form 1932 Download Fillable Pdf Or Fill Online Certificate Of Exemption Streamlined Sales And Use Tax Agreement South Dakota Templateroller

The governments from other states or the District of Columbia are exempt from sales tax if the law in that state provides a similar exemption for South Dakota governments.

. South Dakota Directors of Equalization knowledge base for property tax exemptions sales ratio and growth definitions. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are. How to use sales tax exemption certificates in South Dakota.

This is a multi-state form. Many states have special lowered sales tax rates for certain. Indian Tribes United States government agencies State of South Dakota and Public or municipal corporations of the State of South Dakota Municipal or volunteer fire or ambulance departments.

They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The state that is due tax on this sale may.

Not all states allow all exemptions listed on this form. Business Tax Filing Dates. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

Regulations and general information on South Dakota sales and use tax. Exempt Entities - Higher Education Mass Transit Tribal. Up to 25 cash back South Dakota law provides a similar exemption for unadvertised sales to up to 25 people in the state who buy the shares for investment not for resale during any 12-month period.

These states are Alaska Delaware Montana New Hampshire and Oregon. Search for a job. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Capitol Avenue Pierre SD 57501-3185 605-773-3541 Fax 605-773-2550 Revised 0616 This form is to be used when claiming an exemption from the South Dakota excise tax on. The state that is due tax on this sale may. If not please enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption.

Governments providing a similar exemption are Colorado Indiana Iowa motels and hotels are not exempt Minnesota lodging and meals are not exempt North Dakota Ohio and West Virginia. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that is due tax on this sale. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects.

Send the completed form to the seller and keep a copy for your records. To citizens of South Dakota. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that is due tax on this sale.

These states are -. Governments providing a similar exemption are Colorado Indiana Iowa motels and hotels are not exempt Minnesota motels and hotels are not exempt Ohio and West. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser.

Public schools including K-12 universities and technical institutes that are supported by the State of South Dakota or. Certificate of Exemption Check if you are attaching the Multi-State Supplemental Form. The state that is due tax on this sale may.

Purchasers are responsible for knowing if they qualify to. New items this year that will be exempt from the state sales tax include smoke detectors and alarms fire extinguishers and certain supplies necessary for the evacuation of. Not all states allow all exemptions listed on this form.

Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission. Documentation Required - Government entities must provide an. Streamlined Sales Tax Agreement Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board.

A similar exemption for South Dakota governments. South Dakota Department of Revenue Form. State of South Dakota and public or municipal corporations of the State of South Dakota.

MV-609 South Dakota Department of Revenue Division of Motor Vehicles 445 E. Several examples of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities.

The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption. This is a multi-state form. The governments from states without a sales tax are exempt from South Dakota sales tax.

A South Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them. Some states do not offer all reasons listed. States without a sales tax are exempt from South Dakota sales tax.

445 E Capitol Ave. This is a multi-state form. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax Agreement.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. 26 minutes agoThe 2022 Atlantic hurricane season started Wednesday June 1 and Florida residents can stock up on a variety of supplies during the Florida Disaster Sales Tax Holiday. Exemption are listed on the form.

Efficient filing of DOR tax forms. Not all states allow all exemptions listed on this form. It is the purchasers responsibility to know if the reason he is.

South Dakota Codified Laws Section 47-31B-20214. Please note that South Dakota may have specific restrictions on how exactly this form can be used. Streamlined Sales and Use Tax Agreement.

The South Dakota Department of Revenue administers these taxes. Not all states allow all exemptions listed on this form. This is a multi-state form.

South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments.

Pierre SD 57501. Municipalities may impose a general municipal sales tax rate of up to 2.

Form E1932 V10 Fillable Exemption Certificate

State Of South Dakota Forms Fill Online Printable Fillable Blank Pdffiller

Sdform Fill Online Printable Fillable Blank Pdffiller

How To Start A 501 C 3 Nonprofit Organization Nonprofit Organization Nonprofit Startup Nonprofit Fundraising

Form Rv 093 Fillable Sales Tax Exempt Status Application

Sd Eform 1932 V10 Fill Online Printable Fillable Blank Pdffiller

South Dakota Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Printable South Dakota Sales Tax Exemption Certificates

Sd Eform 1932 Fillable Fill Online Printable Fillable Blank Pdffiller

Frugal Retirees Ditch 4 Percent Rule Hoard Savings Instead Frugal Hoarding Retirement

Form 1932 Download Fillable Pdf Or Fill Online Certificate Of Exemption Streamlined Sales And Use Tax Agreement South Dakota Templateroller

Business Leaders Think These Are The Best States For Education Business Leader Education Historical Maps

North Dakota And Indiana Are The Latest To Join The List Of States That Have Approved At Least A Part Retirement Income Military Retirement Benefits Income Tax

Arizona Student Loan Forgiveness Programs Arizona State Of Arizona Arizona State